Disclaimer: I DO NOT give tips or advisory services. This website is for educational purposes only. Full Disclaimer!!

I started trading stock markets in 2007 and made a lot of mistakes in every sector like, Intraday equity and options trading, share buy and hold, Intraday futures trading, speculative trading and lots of other mistakes. Even went to tips providers and lost money.

My total loss from the year 2007 to 2010 was Rs.700,000.00 (7 lakhs). Out of which I lost Rs.500,000.00 (5 lakhs) trading on my own mistakes mostly hope and greed trading and approximately Rs.200,000.00 (2 lakhs) on trading on tips from various sources. Rs.40,000.00 I paid as their fees in 6 months and lost close to Rs.160,000.00 (1.6 lakhs) trading as per their calls.

The situation was such that I had to take a 1 lakh loan to survive. Till here my wife had no idea what was going on. If you remember in those days (2008) most transactions were done offline. The personal loan approval letter was sent to our house and unfortunately, I was in the office, therefore the postman delivered it to my 8-month pregnant wife. She read the letter and was in shock as she knew I had no reason to take a personal loan.

When I came back from the office she showed me the letter and asked me where has our savings gone. I told her the truth.

After this, a huge argument took place. I was slapped by my 8-month pregnant wife after she learnt about my losses which were 100% of our savings. That one slap and one sentence from her, “If you want to make money from stock markets read & learn, research, work hard and do not speculate”, changed my life and I am very thankful to her for slapping me. I deserved it.

That day, I had no option but to keep quiet and keep saying sorry repeatedly, even after that slap. She was 8 months pregnant so even if I had something to explain, I did not. When she cooled down I promised her that I would never lose money and trade only when confident.

That night is still fresh in my mind and therefore even today I am very conservative when it comes to investment or trading.

I request you to please read the mistakes I made and save your hard-earned money and not destroy it the way I did. Please do not repeat the mistakes I made in those years.

I repeat – Please DO NOT DO these mistakes, if you are doing them while trading. It has cost me more than Rs. 7 Lakhs in Three Years and I Seriously Want You To Avoid the Mistakes I Made. So Please Read Carefully.

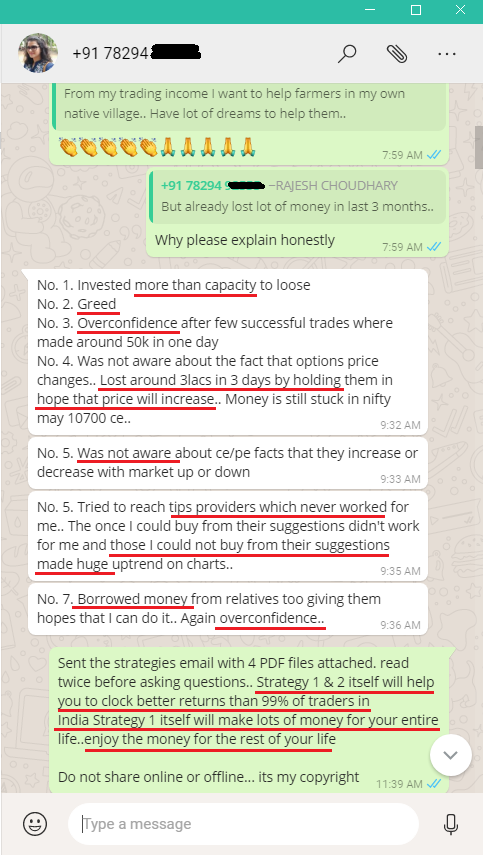

Update Aug 2018: A lady trader who also lost lots of money trading on hope and tips who eventually did my course summed up beautifully the loss made in derivative trading by most retail traders (including me when I was trading without knowledge). Thanks to her:

Note: This article is for people who make trading mistakes again and again. I have done them too. Please avoid these mistakes and you will save a lot of money. Please read the warnings carefully.

Before reading further let me give you a warning – Please educate yourself as much as you can on stock market investments and trading. Please avoid stock trading tip providers and advisory services because I am a victim and lost more than one lakh paying them for tips monthly and investing in stocks or options as per their advice from 2007-2010. After that I realized that only education can help me to trade stock markets properly nothing else can. So from 2010 and even till today, I have kept reading books and good websites on proper investing and trading ideas in stock markets and finances. I devote three hours every day even on Sundays to reading about investing and trading.

NOTE: If you are an option buyer, before you read any further I request you to read this article on why you cannot make money buying options. Of course, you will lose a lot more selling naked options too. I get many calls from traders selling naked options. Unfortunately, all of them are losing money. So you should always hedge your positions.

People looking for tip providers are also making a big mistake. Read why tip providers will not make you any money.

Just like you I had a share trading account. I got it in early 2007 and was excited. I had a well-paid job, so could afford to fund it with some cash. I thought that now I could make a lot of money trading apart from my salary.

I asked my friends to tell me some shares to buy. I also researched the same on the internet. I started buying shares without knowing anything about the company. If someone told me to buy XXX shares I would buy it. In short, I bought shares randomly, a BIG MISTAKE.

A tip in some website – buy the share, in a magazine – buy the share, paid tip provider offering free advice – buy the share.

Unfortunately, every time I lost money. Sounds familiar? Yes many of us have burnt our fingers because some expert advised us and we bought the share only to lose money.

First and VERY Important Warning – NEVER GO TO TIPS PROVIDERS. YOU ARE GUARANTEED TO LOSE MONEY TRADING THEIR TIPS AND PAYING THEM. That is DOUBLE LOSS.

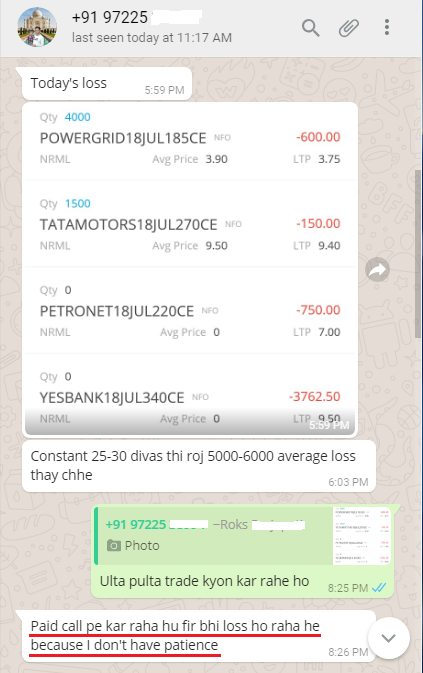

Small update June 2018: See what was happening to one person who was chatting with me before he did my course. He was losing money every day by trading on tips from a reputed advisory firm. When I told him not to trade on tips – he said he doesn’t have patience and still has hopes that there will be some advisory firm that will give him great tips and make him rich one day:

Hope you learn a lesson from his and my losses too when I used to trade on tips, and never pay a single penny to them ever.

Help to stay away from tip providers: Install True Caller app. When someone calls if it shows a red sign, just do not pick up the phone. They will never be able to talk to you.

Warning 2 – Never buy a share because one of your friends or family members told you. Never buy a share because some random tip provider gave you a hot tip. Do your research and buy shares only on dips in small quantities. Add them over time. Bring the average cost down. Buy only good company’s shares. You may have to hold them, but eventually, you will be able to get out in profit.

Then came the meltdown. In 2008 I had more than 6 lakhs in my trading account. And unfortunately, just like many others, I was caught in the stock market crash that year.

Within two to three years I lost 50% of that. By the time it was 2009, my account showed a balance of 2,90,000. 🙁

I had a few shares in my account. They were lying idle. They were 50% of their value. I wanted to hold them. I asked my broker if I could do something with the money that was there in my account. He told me that most share broker companies give a certain percentage of the total value of the shares to trade in Futures and Options. That is called pledging the shares.

It means you can trade even if you don’t have cash but shares in your account. However, it may be limited to 70-80% of the market value of the shares. It’s called collateral. The collateral value differs from stock to stock. This depends on the brokerage company.

This got me excited that I could trade without selling my shares. Wow, I thought I would recover my losses. Read further to know what happened!

I immediately asked my broker to sell one lot of futures of Yes Bank as I thought it was trading way above it should be. Pure speculation by the way, very dangerous.

Warning 3 – Let me warn those who trade futures without hedging, you are playing with fire. Be ready to lose a lot of money. Hedge your futures.

My broker warned me but I ignored it. After 1 hour my broker phoned and told me that I was making a profit of Rs. 3000/-. I felt so happy and asked him to book profits.

I was travelling at that time and felt like a genius.

You know what just after half an hour my broker told me that had I not booked profits, I would have made a profit of Rs. 10,000/-. Though I felt a bit unhappy, I was OK as I thought markets would open every day and I now have a great opportunity to make money and recover my lost money. I was feeling like an expert. What a jackass I was!

That was just beginner’s luck, and this happens to most of us.

Next was IDBI Bank. I asked him to buy a lot of futures from this bank. Done. IDBI bank was at that time trading around 104. I used to always see IDBI bank at 115, so that decision. My broker went on a holiday and asked me not to trade until he came back.

You must be wondering why my broker was so concerned about me. He should encourage me to trade more as he can make more commission. Well, he was taking a long-term view. He knew if I lost money I would stop trading and he would lose one customer for life.

Well anyways IDBI bank started falling. I couldn’t take it. How can my view go wrong? At that point, the IDBI lot size was 2000. Today it is 4000. One point fall in IDBI bank means INR 2000 lost. 103-102-100-99-97-96 all this in 3 days. I just couldn’t believe what was happening. How can a trade go against me?

Warning 4 – No egos with stock markets. You cannot control them. They will behave the way they want to. Praying to the almighty will not help either. The only thing you should do is what is in your control, and that is taking a stop-loss.

I thought enough is enough, IDBI bank cannot fall further so instead of taking a stop-loss I bought one more future of IDBI bank at 96.

Warning 5 – Huge mistake again. Do not do this, never average a losing trade, rather get out of it.

My average came down to around Rs. 100/-. IDBI bank kept falling. Now one point loss was equal to Rs. 4000 – yes Four Thousand Rupees. When IDBI bank fell to around 90 I sold both my futures in panic. A total loss of 100-90 = 10*4000 = 40,000/-. 🙁

Warning 6 – Never over-trade. Especially on leverage. I lost 40,000 in 3 days. Just because I traded above my capacity.

No came more pain. The RMS (Risk Management Service) team of my brokerage company sold some of my shares which I had pledged to trade F& O to recover the loss. Another loss. 🙁

However, it was not all losses I made a few profits too. But unfortunately, profits were booked at 3000 and losses at 10000 or more. You get the point I was losing more than I was making.

Warning 7 – Always have a trading plan. If you are making 2 you should lose not more than 1. In this case, even if you are 50% right, you will make money.

At the end of the year in Dec 2010 my account balance came below 100,000.00. I got very frustrated and closed my brokerage account and took the money out.

I had another account where I used to buy high-risk mid-cap shares to make some quick profits. There too I lost money.

Total loss by the end of year 2010 was around Rs.700,000.00 (Seven Lakhs). Hell, I could have bought a 3-bedroom flat at that time with a small loan. It feels very frustrating to think about that time.

I stopped trading and started doing research. There is nothing in this world that you cannot learn. You need to have a will to learn.

While I lost a lot of money in Futures trading I found that most derivatives traders trade in options for the great limited loss leverage they give. And I also found that most of them trade index options for their liquidity.

Then I started researching Nifty options. My research included what were the best ways to make money from nifty options, whether selling them is beneficial or buying them, whether should we hedge our position or not and why, etc. Some really interesting things came out of my research.

I also read a lot about stock markets, mutual funds, and other financial-related instruments. I still do. The idea was to know enough to make money from the stock market.

If you do not have any knowledge in a particular field how can you expect to make the right decisions? For certain most of your decisions will be wrong. Stock markets are no different.

In 2013 when I was trading full time for a living profitably for quite a few years, I thought why not start a website and share whatever I have read and know with people who visit my site?

And this website was born.

Click to Share this website with your friends on WhatsApp

COPYRIGHT INFRINGEMENT: Any act of copying, reproducing or distributing any content in the site or newsletters, whether wholly or in part, for any purpose without my permission is strictly prohibited and shall be deemed to be copyright infringement.

INCOME DISCLAIMER: Any references in this site of income made by the traders are given to me by them either through Email or WhatsApp as a Thank You message. However, every trade depends on the trader and his level of risk-taking capability, knowledge and experience. Moreover, stock market investments and trading are subject to market risks. Therefore there is no guarantee that everyone will achieve the same or similar results. My aim is to make you a better & disciplined trader with the stock trading and investing education and strategies you get from this website.

DISCLAIMER: I am NOT an Investment Adviser (IA). I do not give tips or advisory services by SMS, Email, WhatsApp or any other forms of social media. I strictly adhere to the laws of my country. I only offer education for free on finance, risk management & investments in stock markets through the articles on this website. You must consult an authorized Investment Adviser (IA) or do thorough research before investing in any stock or derivative using any strategy given on this website. I am not responsible for any investment decision you take after reading an article on this website. Click here to read the disclaimer in full.

My student gets the Winner's Certificate of Zerodha 60-day Challenge - Click here and Open Stock Buy and Sell Free Account with Them Today!!!

Testimonial by a Technical Analyst an Expert Trader - Results may vary for users

Testimonial by a Technical Analyst an Expert Trader - Results may vary for users

60% Profit Using Just Strategy 1 In A Financial Year – Results may vary for users

60% Profit Using Just Strategy 1 In A Financial Year – Results may vary for users

Testimonial by Housewife Trader - Results may vary for users

Testimonial by Housewife Trader - Results may vary for users