Disclaimer: I DO NOT give tips or advisory services. This website is for educational purposes only. Full Disclaimer!!

A Very Happy Dhanteras to you all. Hope prosperity prevails among all of us.

I know most of you will buy Gold Today for prosperity for the entire year to get Maa Laxmi blessings.

Here is the best time to buy Gold, Diamond or Silver:

12.05 pm to 1.27 pm.

To perform Dhanteras Puja:

5.30 to 8.30 pm.

Now some important financial information on How To Invest In Gold this is applicable to all so please read:

1. If you are rich you can buy any jewellery for yourself or your family members today. For you money does not matter so nothing more to say. Or do not buy its your choice.

2. If you are not so rich and cannot afford more than Rs.30,000.00 I suggest for next three or four years buy Gold or Silver biscuits on which there is NO making charges. Preferably gold as it becomes an asset. Make sure they are Hall-Marked as it a guarantee of purity by government of India. Something like 916 and a triangle (Hall-Mark sign) will be made on it somewhere in a corner. Make sure it is there. The gold seller will tell you where it is else do not buy.

In reality this is an investment in a SIP mode where you average out the cost of the gold next 3-4 years. They are available from 1 gram to 50 grams. You can buy whatever you afford.

If gold prices fall next year buy more grams.

After a few years you will have enough gold to sell and buy a big jewellery for your wife or/and yourself and exchange gold for gold. You will then have to pay only the making charges. You will feel that gold you got for free.

It will not pinch your pocket.

3. Gold bonds are also available which you can buy online from your broker. You can ask him and he will tell you how to buy. If your broker does not allow you to buy Gold bonds please fill this form I can help.

[ninja_form id=10]

Gold bonds are more safe and it comes with a guaranteed return of 2.5% a year on the purchase price. But if Gold prices decreases the bond price will also decrease. And similarly if Gold prices increases the bond price will also increase plus you also get that 2.5% interest. So you can do that too.

Please note that buying Gold is different than investing in a Gold bond. Please do not mix them. These are two different things.

Keep your gold safe. If you have too much gold I suggest open a locker in your bank. There is a charge involved please ask your bank manager for that. If you have less then no need for a locker.

Hope this article will help you to invest in Gold.

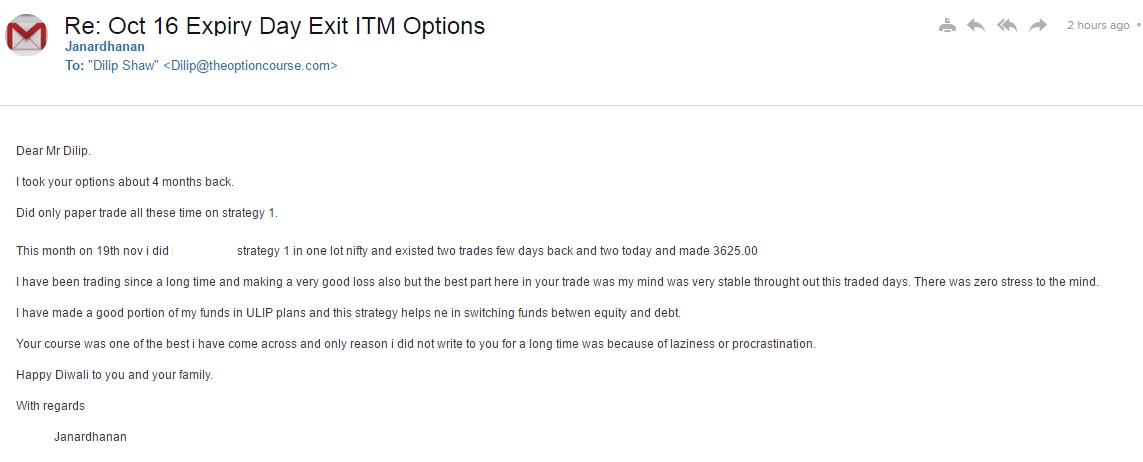

Here is what I got withing 2 hours from one of my course subscriber when I emailed yesterday that some do not even call me for a single doubt after doing my course:

Thank You Mr. Janardhanan.

Click to Share this website with your friends on WhatsApp

COPYRIGHT INFRINGEMENT: Any act of copying, reproducing or distributing any content in the site or newsletters, whether wholly or in part, for any purpose without my permission is strictly prohibited and shall be deemed to be copyright infringement.

INCOME DISCLAIMER: Any references in this site of income made by the traders are given to me by them either through Email or WhatsApp as a Thank You message. However, every trade depends on the trader and his level of risk-taking capability, knowledge and experience. Moreover, stock market investments and trading are subject to market risks. Therefore there is no guarantee that everyone will achieve the same or similar results. My aim is to make you a better & disciplined trader with the stock trading and investing education and strategies you get from this website.

DISCLAIMER: I am NOT an Investment Adviser (IA). I do not give tips or advisory services by SMS, Email, WhatsApp or any other forms of social media. I strictly adhere to the laws of my country. I only offer education for free on finance, risk management & investments in stock markets through the articles on this website. You must consult an authorized Investment Adviser (IA) or do thorough research before investing in any stock or derivative using any strategy given on this website. I am not responsible for any investment decision you take after reading an article on this website. Click here to read the disclaimer in full.

My student gets the Winner's Certificate of Zerodha 60-day Challenge - Click here and Open Stock Buy and Sell Free Account with Them Today!!!

Testimonial by a Technical Analyst an Expert Trader - Results may vary for users

Testimonial by a Technical Analyst an Expert Trader - Results may vary for users

60% Profit Using Just Strategy 1 In A Financial Year – Results may vary for users

60% Profit Using Just Strategy 1 In A Financial Year – Results may vary for users

Testimonial by Housewife Trader - Results may vary for users

Testimonial by Housewife Trader - Results may vary for users