First a Disclaimer: Not every trade can bring the same results but it really helps if you have the knowledge of hedging. Every trader’s results may vary so please do your own research before investing in stock markets. It was because of the hedge knowledge he got from the course that Mr. Ravindra took such a huge risk in his First Trade itself. He is a very experienced trader. It is highly recommended that you start small.

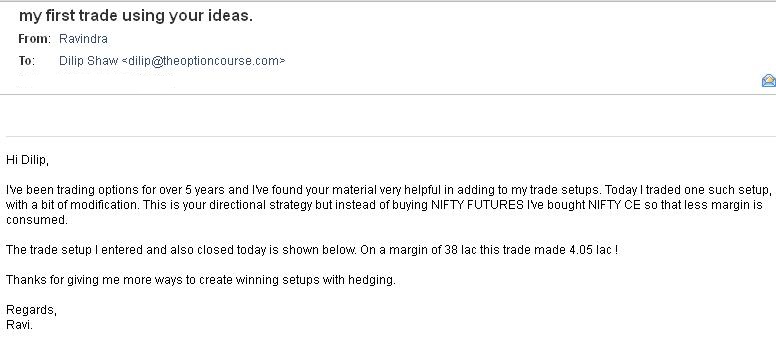

Last month a smart customer took my course and result of his first directional trade is stunning. Yes a 10.65% profit trading Intraday with hedging yesterday. And the best part is the trade was NOT a copy cat as written in the document – he bought Nifty Call Options instead of Nifty Futures buy. The calculated risk paid off. We will know shortly why he preferred to buy the Call Option instead buying a Nifty Future.

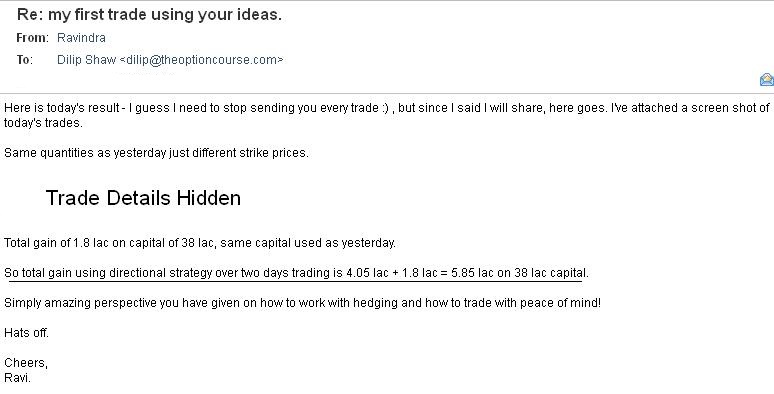

See his yesterdays’ email (please click on image to enlarge to read properly):

Testimonial by Ravindra – January 2016. 10.65% Profit Intraday Rs. 4.05 Lakhs in Directional Strategy of My Course – Results may vary for users

Some guys are smart really. Hey don’t we have students better than teachers all over the world. 🙂 Well it looks like its in my case as well and am so proud of my customers. 🙂

Now if you work this out it is (4.05/38) * 100 = 10.65% ROI (Return on Investment). So this looks like a great return. I have always said, people who can master the directional strategy can make more than 3% a month. Some are making more than 3% per month even in non-directional. 🙂

Whenever you are taking the directional trade you should know your maximum risk BEFORE you take the trade. People who have taken my course know that profits can be unlimited especially if you are wrong in predicting direction.

And how many times did you took the Nifty Futures trade and got the direction wrong? I am sure most of the times. But what if you can make more money if wrong? 🙂

Note: Ravi converted the positional directional trade (Futures hedged with Options) into an Intraday trade. It was an Intraday trade done Monday, January 04, 2016. Please also note that he did not buy the Nifty Future, but bought the Call as he wanted to go long on Nifty, but was horribly wrong and was awarded Rs. 4.05 Lakhs by markets in a single trading day because he was wrong in predicting direction. How many times has that happened to you? 🙂 Aren’t we punished by markets whenever we are wrong? Add to that the worries we have, when we trade Nifty Futures naked (means without hedge). All that worries will go if you are hedging.

He also bought the Call Option to save money on margin. For Future Buy/Sell your broker will block at least Rs. 40000-45000 for 1 lot Nifty. But here he pays the option premium multiply by the number of shares bought. This reduced his margin by a whopping 75%. He traded in 7500 shares or 7500 / 75 = 100 lots. This is another reason why he got an increased ROI.

If you have taken my course please do not ask me why he bought a call. This was a smart move by the trader – more to do with trading with less margin and to get an increased ROI. This is where your brain comes in. 🙂 Returns will be more if you can use your intelligence plus the knowledge you get from the course.

How many times you made money when you were wrong in direction? None I think. That is what I call beauty of hedging. It not only protects your capital but it can make money as well.

Agreed it will not make money always – but understand this – when it makes it makes unlimited money and when it losses the losses are limited and you can wait for profits to come. Two great trades and you are done for the month. On top of that, you need not be correct on direction. What more do you want?

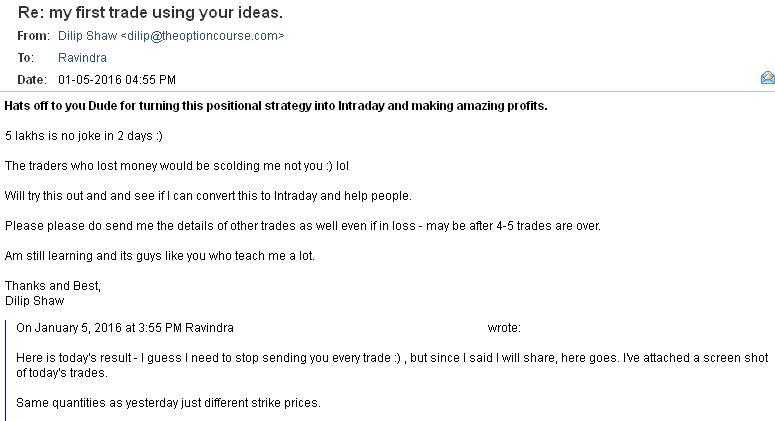

When I replied “great trade” this person replied this:

Testimonial by Ravindra – January 2016. 10.65% ROI in Directional Trade of My Course – Results may vary for users

Update on Monday, January 04, 2016:

Now this is amazing. As promised he shared his trade details done today. Ravi had another great day. He made another Rs. 1.80 Lakhs trading Intraday on the same directional strategy only with options. Surprisingly there was no movement today, but still the trade made a profit. Note that the trade needs movement to make money. It does not matter which side.

See this:

So profits in 2 trading days:

Rs. 5.85 Lakhs on 38 Lakhs.

ROI (Return On Investment): (5.85/38) * 100 = 15.39% in 2 trading days. Amazing. Hats off to him.

I have written him to continue sending the trades so that I can see if I can convert this into Intraday Trading. Lots of my subscribers are looking for Intraday strategies – and if research proves it to be good then lot more traders can benefit.

I personally do not like trading Intraday, but if something good comes out – then I am Ok.

Lets wait and watch how this one plays out. I will start start doing some research on this.

Thanks Ravi for trading with Guts and Brains. Like I always say: If you are doing it right, hedging your trades, and know what you are doing – over time you will make money.

Calculated risk taking traders will play out well in the long run, speculators will phase out in long run. Unfortunately humans love to gamble and therefore more than 95% of traders are gamblers who lose money.

I hope you do not.

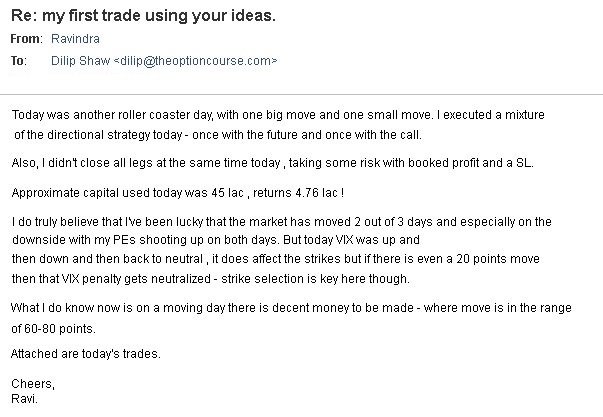

Update on Monday, January 06 2016:

Mr. Ravindra has another Roller Coaster Day. Makes Rs. 4.76 Lakhs Profit on 45 Lakhs margin blocked. Here is his today’s email.

4.05 Lakhs + 1.80 Lakhs + 4.76 Lakhs = Rs. 10.61 Lakhs Profit in 3 Intraday Trading Days – Results may vary for users

I have got just too many requests today from my clients to share his trade details and I have not sent it to single person. The reason is pretty simple. I want to be 100% sure this directional trade can be converted to intraday trading. Until and unless I am not pretty sure I will NOT share his details.

Today he took some risks. There were a total 4 trades and he booked profits in ALL the trades. Since it was intraday he kept booking profits in different legs at different times. This is his intelligence and the credit goes to him.

Yes he took calculated risk for the day and it paid off since he knew even slight whipsaw (change of direction) of Nifty will bring him profits in all legs. It worked.

Very Important Note: Mr. Ravindra took the course on 26-Dec-2015. Paid 5000. Did not email me for a single doubt and takes his first trade with a margin of 38 lakhs. He has experience of 5 years in options trading. How many of us even with 10 years of experience can do a course and risk 38 Lakhs on a single trade? This person has the guts. Even if you are a crorepati can you risk 38 Lakhs in your first trade after doing a course? On top of that he converted the positional trade to Intraday. Which means he is very experienced and smart trader. This is the reason I am not sending his trade details to anyone right now. People will start copying.

But its easy to know what he did which is there in his email itself. Except for today’s trade where he did buy Futures, he just bought the ATM Call Option instead of the Futures. Rest of the trade remains more or less same. So please look into the document I sent you and start experimenting. Paper trade first and see how it goes. Then do the real trading on a single lot. Remember he is doing it Intraday – so paper trade Intraday only.

Ravindra’s total profit in last 3 trading days:

4.05 Lakhs + 1.80 Lakhs + 4.76 Lakhs = Rs. 10.61 Lakhs

ROI: (10.61/40) * 100 = 26.52% in 3 Days.

Amazing!!!

Enjoy Ravindra Hats Off.

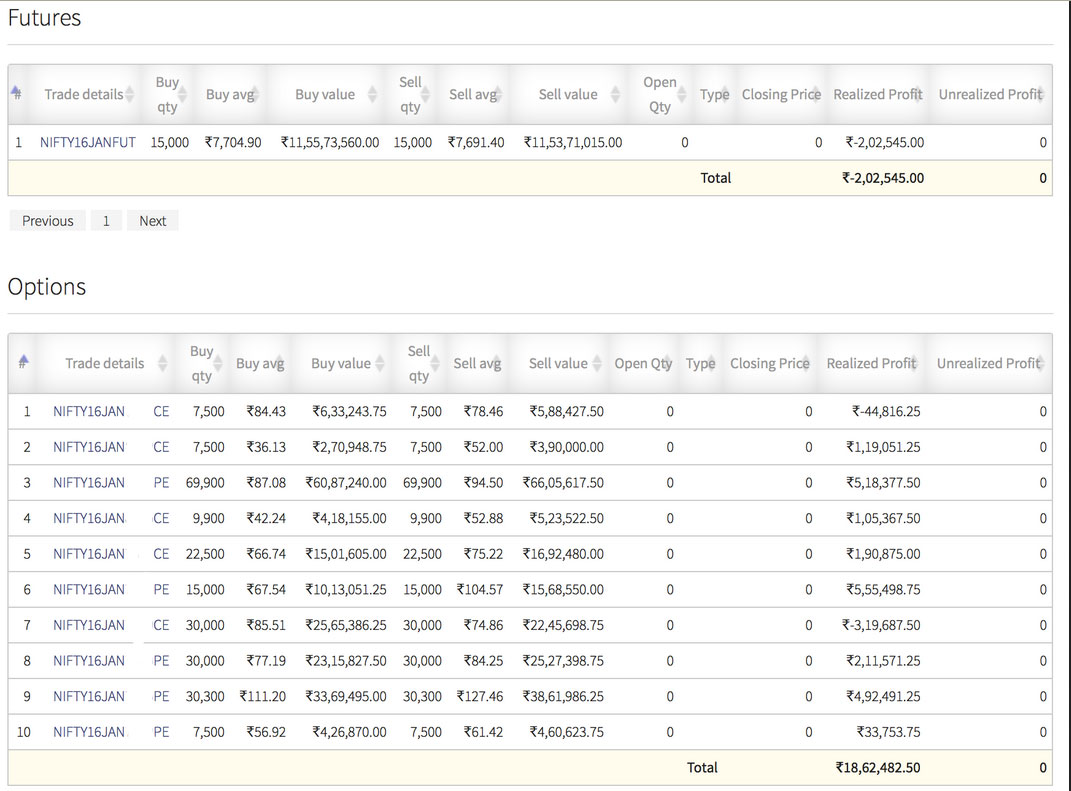

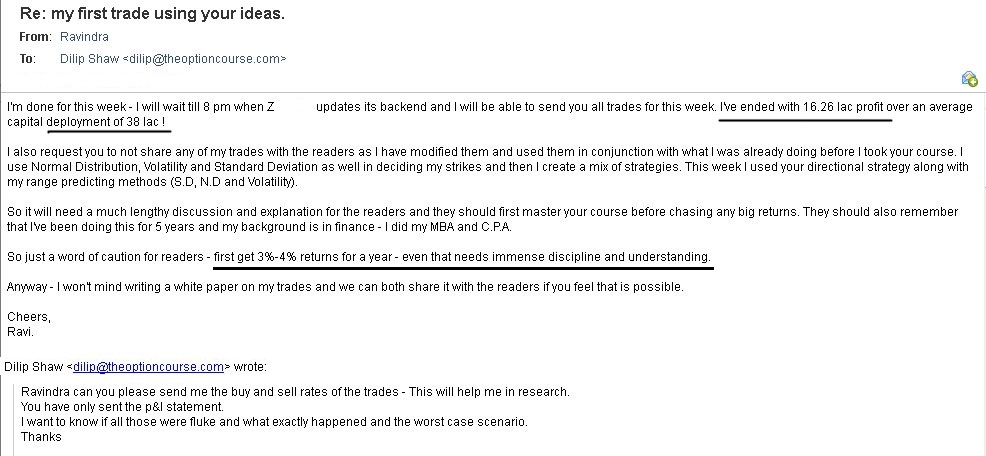

Ravindra’s total profit ending this week is Rs. 16.26 Lakhs on Rs. 38/- Lakhs margin blocked

Ravindra’s total profit ending this week 4th to 8th January 2016 is Rs. 16.26 Lakhs on Rs. 38/- Lakhs margin blocked. This is (16.26/38) * 100 = 42.78% return in 5 trading days. Humongous!!!

In the last few days I got many requests from my paid as well as non-paid customers to show his trading details. Unfortunately Ravindra was NOT comfortable, but when I told him his personal info will not be revealed he readily agreed.

Here is the screen shot of his profits for the week taken out from back end of Zerodha.

Rs. 16.26 Lakhs on Rs. 38 Lakhs margin blocked. 42.78% return in 5 trading days – Results may vary for users

I got quite a few emails where some people suspected this to be fake. Let me tell you that I do not lie, at least on this website. I know you people trust me and breaking trust is something I am yet to discover.

But please remember these kinds of returns are not possible from every trade or trader. You must have expertise like Ravi to get such kinds of returns. Look at his qualifications – he is MBA and CPA. And am sure he was doing good even before he took my course.

Here is his email:

I do not even take credit for his returns. He learned hedging from the course and took advantage of the knowledge – that’s it. Note that he changed the strike prices as per his views that day. Even entry and exit of all legs were timed differently. This cannot be taught in a course.

This is something that will take you months to master. Therefore even I was reluctant to show his trade. Next day Nifty changes and so the strike prices – but I know there are lot of people with a lot of money who would try to copy the trade and of course fail and blame me for that.

He commented below is apt, which I must mention here:

Dear Dilip,

I cannot tell you how much of an eye opener your hedging techniques have been. So far I use to work with a strict SL and now with your hedging techniques I can take more risk knowing that there will be multiple exit opportunities for each legs of the trade.

Anyway – my humble advice is , mastering the 3%-4% returns per month trades until one has the epiphany and starts his/her own financial engineering. Bottom line is, understanding the setup and the strikes. It comes with experience and most of all by making mistakes 🙂

Cheers,

Ravi.

I have therefore hidden the strike prices but people who have taken the course may get some idea about it. But please understand that even I do not know when he entered and exited the trade. Guess work can be counter-productive.

Ravi has promised me to come with a white-paper on this. And he also wants to write on this blog for free. He is a class apart trader and therefore I think he fits great to write for us and help this community.

And most importantly he is NOT charging me anything to write in the site. Thank You Ravi. We all will be really grateful to you, especially the Technical Analysts who visit this blog. All articles written by him will be attributed to him.

Thank you for this extraordinary week Ravi. We all learned a lot. 🙂

Very Imp Disclaimer: These results are typical and its not guaranteed that every trade will produce the same or similar results. However the hedging methods in the course will help you to take such aggressive trades even with a lot of cash. Because you know that capital protection is there no matter what. Smart traders will always make more.

If you are an experienced Future trader I can only say that the hedging methods in the course will help you a lot. Since this hedging will take stress off your mind because of either limited losses or unlimited profits, you can trade better and make better income.

After the course you will actually start looking for the worst tips providers in India and hope their Future direction is wrong. No I am not joking – this is how you can make more money. 🙂 Well you still make money, though limited if right.

Details of the course is here.

Click to Share this website with your friends on WhatsApp

COPYRIGHT INFRINGEMENT: Any act of copying, reproducing or distributing any content in the site or newsletters, whether wholly or in part, for any purpose without my permission is strictly prohibited and shall be deemed to be copyright infringement.

INCOME DISCLAIMER: Any references in this site of income made by the traders are given to me by them either through Email or WhatsApp as a Thank You message. However, every trade depends on the trader and his level of risk-taking capability, knowledge and experience. Moreover, stock market investments and trading are subject to market risks. Therefore there is no guarantee that everyone will achieve the same or similar results. My aim is to make you a better & disciplined trader with the stock trading and investing education and strategies you get from this website.

DISCLAIMER: I am NOT an Investment Adviser (IA). I do not give tips or advisory services by SMS, Email, WhatsApp or any other forms of social media. I strictly adhere to the laws of my country. I only offer education for free on finance, risk management & investments in stock markets through the articles on this website. You must consult an authorized Investment Adviser (IA) or do thorough research before investing in any stock or derivative using any strategy given on this website. I am not responsible for any investment decision you take after reading an article on this website. Click here to read the disclaimer in full.

My student gets the Winner's Certificate of Zerodha 60-day Challenge - Click here and Open Stock Buy and Sell Free Account with Them Today!!!

Testimonial by a Technical Analyst an Expert Trader - Results may vary for users

Testimonial by a Technical Analyst an Expert Trader - Results may vary for users

60% Profit Using Just Strategy 1 In A Financial Year – Results may vary for users

60% Profit Using Just Strategy 1 In A Financial Year – Results may vary for users

Testimonial by Housewife Trader - Results may vary for users

Testimonial by Housewife Trader - Results may vary for users

Comments on this entry are closed.

I believe the luck played big part here. Imagine the VIX would have dropped suddenly having the same setup then he would have lost money in call and puts. That time hedging would not helped also.

One correction here Himanshu – BOTH of the trades above were Intraday. When you trade Intraday VIX does not matter much as the swing in VIX will not be there at least in most days. So now we are left with pure delta of options. So I would say smart move and small luck because of the huge move yesterday. But he made a profit again today when there was little move in Nifty. What can you say for that? Luck again? I am not saying that he will never lose. But I have calculated the max loss and it is so small per trade that one good trade will take care of 4-5 losses. In between am sure he will get another good day. Will keep a watch on this. This is interesting. He has surprised me too. 🙂

If it is intraday then I have to agree that VIX will not an impact. With this it is going very interesting for me. With little Nifty movement if Ravi can earn good money then I have to believe he is very good trader and experienced in selecting strike. Could you please take permission and share the strikes at which he took positions?

As I guessed, Ravi also mentioned the same thing in his mail. Strike selection is key here. You choose wrong strike and fail to take exact decision on VIX, expiry time etc, you are doomed.

Please follow Dilip trading directional strategy until you are sure on all impact.

Bang on Himanshu. Absolutely right. This is the reason I am not sharing his trade details with my paid customers though I have numerous inquiries. Without using their brains they will copy paste and that’s really not good. Next trade he will for sure change the strike price. I am also looking into it. This guy has shocked me too. Unfortunately yesterday’s buy sell prices he did not share, but only the profits. The fact that he has mastered booking profits at difference intervals shows his class as a trader. I will research it and will share it with paid customers later with my inputs.

So right now my only advice is follow the strategy as it is for now. Practice it. Just do not try to copy anyone else. Try to be smart yourself.

And one more thing – profits were MORE yesterday when he used the strategy AS IT IS. He actually bought Futures and hedged with options.

Market has rewarded Ravi on being expert with no emotions. Imagine the profit of 4 lakhs and need to take decision on booking or not. But he booked it. Truly a class trader. Dilip, you are lucky to have subscriber like him.

Very true. He has given me a lot of things to research on this strategy. One of my customer who took the course yesterday back-tested with his software and finds this works amazing Intraday. So I have a new angle to this. If I find this trade to be correct on statistically significant tests, a lot of Intraday traders can be helped.

Dilipji,

If we go for intraday using Ravindra’s theory, we should strict follow rules as below:

1) Keep an eye on screen, up to trade close.

2) Take advantage of stop loss, by machine, not in mind.

3) Money management by R/R.

4) Most important is that we do it only before two week of expiry month.

** paper work is necessary as back testing.

THANK YOU

1, 2 and 3 correct. On the 4th I can say that this trade can be taken any day irrespective of expiry day.

In your paid course will you teach A to Z in F & O . That is person having no knowledge about Derivatives also can learn everything from your course.

No. I do not teach basics of options. But its easy to learn. There are a lot of stuff for free online. Just Google basics of options and futures and you get a lot of nice articles. Read and then take my course.

Thanks.

Superb.

Happiness is the first result, when mind is tension free, because of hedging

Profit is the second result, when mind is tension free, because of hedging.

Creativity is the third result, when mind is tension free, because of hedging.

Dilip Sir, Thank you.

Mr. Sunil R Nair 🙂

Very apt comment. Hedging is an arsenal while trading. It not only protects your capital but can actually make profits in the trade. As it is clear from all three Ravindra’s trades.

Hello Dilip JI

One question is how he can save substantial in terms of margin involved…..

If you trade Futures your broker will block more margin. If you instead buy a Call or Put you only pay the premium. So you save on margin.

If no movement intraday,

How much would be loss in ravindra case,

On same margin.

His max loss was 20 points. That too in worst case not Intraday. Very clever. 🙂

Also, his strategy wont work on decreasing vix, i think.

Because in delta hedging you purely bet on volatility.

Sir please correct me if wrong!!

True.

Its just pure luck and courage. Hedging helps that’s a fact.

Luck is when you trade for the first time and get lucky. But what you say when the trader is getting lucky almost every time he trades? That’s certainly not luck. There is something more. Ravi plans his trades well, and knows what he is risking and how much he is willing to risk. This is called strategic planing, not luck. When you keep doing the right things, you keep getting lucky. BTW Ravi is still killing it almost everyday, but unfortunately he is not very comfortable in sharing anything more, and I have to honor his wish. Thanks for saying hedging helps. 🙂

If Ravi is killing it everyday, I wonder Ravi will be billionaire soon. Best of luck to him 🙂 Wish he didn’t put a wrong move one day and wipe his soft earned money. I know he won’t. He knows the secret now.

Dear Dilip,

I cannot tell you how much of an eye opener your hedging techniques have been. So far I use to work with a strict SL and now with your hedging techniques I can take more risk knowing that there will be multiple exit opportunities for each legs of the trade.

Anyway – my humble advice is , mastering the 3%-4% returns per month trades until one has the epiphany and starts his/her own financial engineering. Bottom line is, understanding the setup and the strikes. It comes with experience and most of all by making mistakes 🙂

Cheers,

Ravi.

Ravi, you have given new angles to this directional strategy:

1. Trade the option instead the Future.

2. Time the exits and try to exit all legs with profits.

3. Try trading Intraday.

This is awesome and is an eye-opener for me as well. Never thought on those angles. If you have taken my course, try to practice what Ravi has written. I can assure you with practice you can also achieve similar results.

Thanks for your comment and thanks for showing all traders that such extraordinary returns are possible with trading options.

Hats of to you. 🙂

Dilip ji,

Plz correct the line

” Teo great trades and you are done for the month ”

as

” Two great trades and you are done for the month “.

(This line is 3rd line in 12th para of the post from Top)

for the benefit of future readers of this post.

ThanQ for educating us relentlessly.

– M S Rao

Done. Thanks Mr. Rao.

Thanks a lot to both Dilipji and Raviji…..your trades/strategies are helping us to regain our confidence that we almost lost.

I am also one who was also requested to reveal Ravi’s trades…I am sure Dilipji had also lot of pressure from others also …but Dilipji had taken a good decision by not revealing it…I think it would be more disaster…

Also I thanks Dilipji for sharing it with every one of us, he could have kept it with him ….

Waiting for a white paper from Raviji eagerly….

Cheers

Yes copy-paste was the reason not to reveal. I could have made money of it as well, but for some strange reason “easy” money now does not motivate me. Me too awaiting Ravi’s white paper.

Sir I have never seen such a intelligent trade as ravi sir.

True me too. Especially on such a large scale. Brilliant work. Yes you are right he deserves the title “Sir”. 🙂

what is the minimum capital required for any novice to start with your directional and non directional strategies ?

80000 Amit. Remember that this is a business as any other business. The more you have the better especially if you perform.

Dilip ji,

Plz correct the lines :

†He learned hedging form the course and …. â€

as

†He learned hedging from the course and …. “.

and

†This cannot be thought in a course. “

as

†This cannot be taught in a course. “.

for the benefit of future readers of this post.

Seems U r overworking.

Anyway Thanks once again for educating us relentlessly.

M S Rao

Done Sir. Thanks a lot. Yes overworking.

Thanks a lot Dilip ji & Ravindra ji… highly appreciated for sharing such a brilliant work. I am sure soon we will be fortunate enough to learn (not copy paste) from you the basics of such brilliant strategies which we can apply on a smaller scale commensurate with our risk capital. Great work indeed… Please keep it up and do keep sharing such brilliant work in coming weeks also. Cheers.

Thanks. Yes I know, but unfortunately most people will copy paste so we both decided to hide the strikes. Let me see if I can reveal. I will ask Ravindra for that. In any case even if I reveal the strikes, it will not be clear at what time he bought and sold.

DILIP SIR

ONE LITTLE CONFUSION SO FAR MARGIN REQUIREMENT.

IN THIS STRATEGY I THINK MARGIN WILL BE THE SAME IF WE BUY FUTURE OR CALL. ONLY ONE SIDE MARGIN REQUIRED.

PL CORRECT IF I AM WRONG

Buying call/put requires LESS margin than buying or selling Futures. Thanks.

Hi.,

This is Thenmozhi Kanagarajan. Small correction on 10’th of January reply.

The line should be ” Buying call/put requires LESS margin THAN (not then) buying or selling Futures. I think U R over-straining.

Regards.,

Thenmozhi Kanagarajan. Coimbatore TamillNadu

Thanks Sir. Corrected 🙂

I am not an expert in English, so please forgive (and correct) such mistakes. Regularly writing for the blog all alone is not an easy job really. If I outsource the quality of the blog may suffer. Though people like Ravi are most welcome. He has agreed to write. Lets see.

Yes Sir, working from 9 am to 12 am the whole day. I need to reduce the work load now.

Thanks and please if you find any mistakes just let me know and I will correct.

We are eagerly waiting for Ravi sir article which will teach us the techniques of option trading with hedging.

Ragunathan, Coimbatore

Here it is RAGUNATHAN:

Ravi’s White Paper on his Excellent Trade that made him richer by Rs.16.26 lakhs on 38 lakhs margin blocked in 5 days flat.

Dilipji,

Ravi is an excellent trader without any doubts. And you are very helpful enough to atleast reveal that one of your customers is making such good profits with the directional strategy. I appreciate your genuinity.

Two things particularly I notice from your writeup :

1. Strike selection is the key

2. There is money to be made with 60-80 points movement ( Ravi wrote this in his mail to you )

The current average daily range of Nifty is around 100 points. So I believe the strategy holds a lot of promise. I am a new customer, bought the course this week only, have yet to trade the strategies. But I know I am with Genuine people in the industry.. thanks

Yes Yogesh, like Ravi if you too practice, you can also get similar returns. Ravi’s profits does not end here he is still rocking but unfortunately he is not comfortable in revealing more, and I have to honor his wish. I can only say that with hedging FEAR is OUT. That makes a huge difference to your trading.

Dilip Da is right – hedging allows you to deploy more capital and hence returns are good when a strategy works with known limited loss.

I would love to share my daily trades but I am truly , honesty, as god is my witness, tell you – I’ve got here by no luck or no magic wand. I was struggling for 3-4 years before I’ve found what works for me.

This course has allowed me to flex my muscles with the capital knowing that hedging is going to take care of worst case scenarios !

Thanks Ravi.

Hi,

Encouraging and fearful story!! Almost escalates one’s thought process to trade with more volume and end up giving profit to someone like Ravi who is waiting for new person to make such mistake.!!

“Here is the screen shot of his profits for the week taken out from back end of Zerodha.” Is this screenshot shared by him? IF yes the why this comment “back end of Zerodha” seems like Zerodha can give access to 3rd person if one agrees to share?

Don’t get me wrong but your comment that you will not share with your readers is appearing more than three times in this post!! Like you are counteracting the very basis of foundation on which you started your course and that is not be in day trading and have peace of mind and patient!!

All of us know how dangerous is day trading but this post is full of underlying current that high profit possible on day trading if they follow your course and all I can say it can be true for some especially “RAVI” a legend created.!!

I would love that you stick your very basic plan!!

Adesh,

I have always encouraged anyone taking my course to start trading with 1 lot to gain confidence and experience. Then they are free to increase lot size “gradually”. This I remind them again when I send them the written materials for the course.

Same with Ravi. But he is experienced trader. He simulated the trades probably in some software and was “comfortable” with the max loss, that’s the reason I think he risked 38 lakhs straight away in the first trade itself. Though for most traders its not recommended.

Yes the screen-shot was shared by him. How can I or anyone else login to his account? It is his account and he shared the screen shot. “Back end of Zerodha“? I think you do not have an account with them. They have a back-end system to download account statements, contract notes, capital gain tax for any month to any month etc, and more, which I think most brokers lack. End of the week Zerodha updates the trades and you can login and get a consolidated statements of profits and losses to see how you fared.

I am not sharing his real trade due to a lot of reasons, the biggest one is people trying to copy. Since this is post open to all people who haven’t taken my course may try to “duplicate” the trade next month not knowing exactly why and when these trades were taken. This may prove to be counterproductive. As you know half knowledge is dangerous I am not sharing it with all.

I may share later with my inputs on this strategy so that my paid customers can benefit.

I still say its better not to trade Intraday. But for people like Ravi, who are experienced – they are free to take their own calls. The strategy by the way is NOT Intraday. Though he converted this beautifully by chance.

I have never said that high returns are possible through day trading any where in the post, in fact anywhere in my blog. If you are getting it wrong then I cannot help.

Please read this white paper by Ravi to get the facts. Agree with you, some people make a killing Intraday, but I don’t sell strategies that work Intraday. Period. And I tell this to everyone who calls me to inquire about the course. I lose a few customers because of this, but I am OK.

RAVI is a real trader by the way and all of the above you are seeing is correct and genuine. I cannot create legends, nobody can – people work hard and become legends. And I cannot force anyone to believe anything. It is up to you to believe, but all I can say that all emails and trade details are genuine.

No body is buying this course because they can copy Ravi, they buy to learn the strategies that is it.

>> I would love that you stick your very basic plan!!

I didn’t understand this. What is my basic plan can you please elaborate? BTW this is my space, my home. You are free to suggest, but I will do what I feel like doing – and I will keep teaching option traders as long as I can.

Thanks for your motivating comments.

Basic plan mean your genuine style. You simply don’t promote intra day trading but this post and the way you promoted it and saying that you will look into it to benefit people who love intraday trading, has this sense that you can a great winner if we do intraday. We all know it’s almost gambling if you are not aware properly and you comments merging with kind of profit Ravi had, promoted someone to focus here and people like Ravi wait for such person

Hold you get my point. Yes it’s your space and home and your course, there is no denying. that but hold you are getting my view.

Also, I am not saying intraday is not allowed. It’s the way all trading houses want. Money for them everyday is for sure if one does. But yes it’s there most common cause lots loose their money and all those managers win.

Adesh,

In each and every testimonial in my site you will see this – “Results may vary for users”. So everyone reading understands that their results may differ. Some people do very well in trading some don’t, and that’s true with every business including Intraday trading.

Experienced trades come to my site not beginners, and they can understand easily whether what is being said by me has value or not. It’s foolish to try to fool experienced traders, and that is not even my intention.

Looks like you didn’t read the FIRST PARA of this post itself: First a Disclaimer: Not every trade can bring the same results but it really helps if you have the knowledge of hedging. Every trader’s results may vary so please do your own research before investing in stock markets. It was because of the hedge knowledge he got from the course that Mr. Ravindra took such a huge risk in his First Trade itself. He is a very experienced trader. It is highly recommended that you start small.

That tells the entire story. And where did you find that I am selling Intraday strategies? Not a single line in my whole site says if you buy my course you can become an expert in Intraday trading. All I said is that Ravi “converted†my strategies to Intraday – which is the fact. You mean to say I should have concealed the facts and told my visitors something else? I am not even taking credit for what he did. Someone else would have written 100 times “because of meâ€, “because of meâ€. I didn’t. If Ravi made it Intraday then its Intraday and I cannot lie to my blog’s visitors. You are free think whatever you may feel.

Backend, is like a back office. Whatever broker you are using, you will only know at the end of the day your NET PROFIT. Anyone who trades with Zerodha will know this.

Can I have access to your trading account without knowing your password ?

Also, Dilip is not trying to create a “legend” story here , he has everyone’s best interests at heart and isn’t leading anyone on to believe they can expect similar returns. Heck, even I am not expecting February to be as fab as Jan. I made a lot of my money in Jan on panic. And panic in the markets is maybe 1 or 2 months of a year.

So yes, stick to the 5%-6% a month plan its very good. As you keep trading you will find financial engineering opportunities to better your returns.

Cheers,

Ravi.

Hello everyone,

I feel the main deciding factor for any trade should be the ‘RISK’ for the desired returns. It doesnt matter whether you are trading Intraday or positional. If you are properly hedged and the risk is defined and under control, then I think there is no harm in squaring up the trade intraday.

Though I am not aware of the trades Ravi took , but I am sure he squared up his trades intraday because the market moved enough to give him sufficient profits he had planned for. Otherwise, if the markets would have been flat, he would have carried over his trades the next day. Just a guess…..

The main point is that let the Market decide when we should get in and get out.

Thanks

Exactly Yogesh, this is what happened with Ravi. His intention was not to trade Intraday, but when at 3 pm you are sitting at 4 lakhs profits Intraday, then I would say its foolish to leave money on the table for the next day. He grabbed it – good move.

Yes if the profits were less, I am sure he would have left it for next day.

Thanks.

Nice observation.