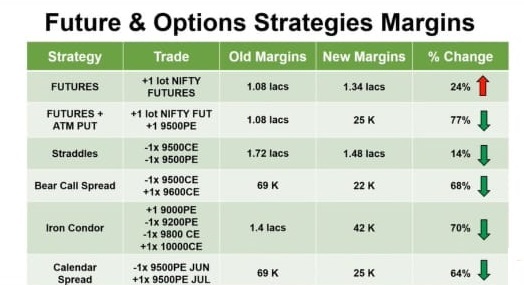

The new margin rules for hedged future and options trades coming into effect from 01-June-20 reduced the margin required. It is very good for retail traders, as it reduces the unlimited risk of naked trading.

Here is a detailed very technical explanation by NSE – National Stock Exchange of India Ltd., on the reduced margin framework from 01-June-20:

https://www.theoptioncourse.com/NSE-New-Margin-Framework-01-June-20.pdf

Well, the above file will be a bit complicated to understand. I will try to explain in simple language.

Before I explain here is a fact. Up to 31-May-20, India was the only country in the world where a hedged trade margin was at least 500% more than any other stock market in the world.

This was highlighted by many stockbrokers in various meetings to The Securities and Exchange Board of India (SEBI), NSE (National Stock Exchange) and BSE (formerly known as the Bombay Stock Exchange Ltd), since many years but it all fell on deaf ears.

Finally, Mr Ajay Tyagi (appointed chairman on 10 February 2017, replacing U K Sinha), who took charge of the chairman office on 1 March 2017, finally approved to allow the new margin rules as it is followed in the western countries.

So finally to the relief of retail traders and brokers the new margin framework rules, went live on Monday, June 1st, 2020, for future and options trades.

Please note that there is one more margin rule change that went into effect from Monday, June 1st, 2020. From this day margin block will increase for un-hedged or naked option selling and future trades. The rules on reduction on the margin swayed away from this news as brokers want more safety for their clients and in-turn for themselves. Every broker advertised the reduced margin rules.

This is what happened on margin rules for naked derivative trading:

Price Scan Range is used to determine the future and options margin. The price scan range is the probable price change over a one-day period and is referred to as standard deviation sigma. The standard deviation (volatility estimate) shall be computed using the Exponentially Weighted Moving Average Method (EWMA). Since the Price Scan Range is directly related to the volatility estimate, it will change as per the volatility index (India VIX).

What amount of margin will increase for un-hedged/naked derivative trading:

From Monday, June 1st, 2020 Price Scan Range will be changed to 6 sigma from 3.5 sigma. Thus when the markets are volatile and if India VIX increases – which it does – then the Price Scan Range will also increase leading to higher margin for naked trades (option short/future buy/sell). This can go up to 20% increase in margin compared to what it used to be till 31-May-20, in volatile market conditions and up to 5% increase on normal market conditions. Which means margin will reduce significantly as the volatility in the market drops. Higher Price Scan Range also means that there will not be a sudden spike in increase or decrease of margin going forward, it will be gradual, still, it will be higher than compared to what it was before June 1st, 2020.

Why Price Scan Range was increased to 6 sigma from 3.5 sigma when brokers up to May-20, were able to manage naked trades?

This was done deliberately to discourage naked option sellers and naked future traders. I support this move. I was and am and will be in future, totally against naked option selling and naked future trading as this can bankrupt a trader in a single trade. 99% of derivative traders lose a lot of money in a single trade, is for this reason alone – naked trading.

Right from the start of this website since 2014, I have been telling via my newsletters and posts to always hedge your trades for either small profits or small loss. Hedging the trades keeps you comfortable, stress-free and mentally fit. Naked trading keeps you stressed – and a stressed trader cannot take correct decision when a trade is live in the market. 80% of the times they will make the wrong decision.

I Will Now Discuss The Reduced Margin For Hedged Trades

Note: The given below margins are for my research account held in ZERODHA. If you also want to open an account in ZERODHA, you can click here are start the process to register online.

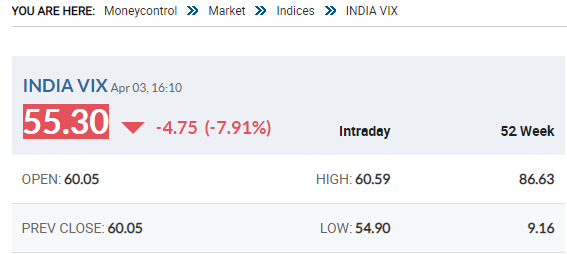

I waited for a few days for INDIA VIX to come to the normal band, but I could not wait any longer to complete my research on reduced margins for hedged trades. I was waiting since 2011-12 for this. This was the year I studied somewhere, that in the US they block only the max loss possible, plus some more for brokerages and taxes for a hedged trade. In India, they treated a hedged trade and shorted option as two different trades and therefore blocked the entire margin to sell an option. I had no idea why, but since beggars can’t be choosers, I had to trade what was offered to me. Thankfully even with higher-margin, things went well. 🙂

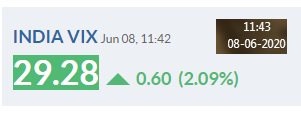

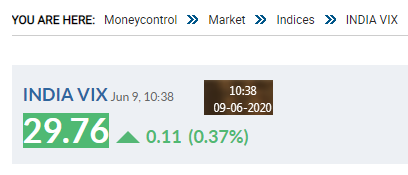

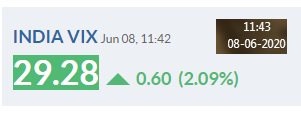

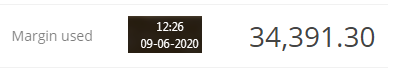

Since I couldn’t wait any longer, on 08-Jun-20 I took a Bear Call Credit Spread trade on one lot. Please note that volatility on this day was higher than normal. INDIA VIX (India’s Volatility Index) was 29.28. As per my experience if India VIX is above 25 – its high. 15-20 is considered normal, 20-25 is considered above average, 25-30 is considered high and above 30 is considered very high.

What is Bear Call Credit Spread?

A Bear Call Spread, or Bear Call Credit Spread, is a type of option hedged strategy used when an options trader expects a decline in the price of the underlying asset. The maximum profit to be gained using this strategy is equal to the credit received when initiating the trade. However, the bought option will reduce the profit but will keep the naked option unlimited losses capped – thus its called a hedge.

Here is INDIA VIX on 08-Jun-20 – see that it’s high:

India VIX on 08-Jun-20

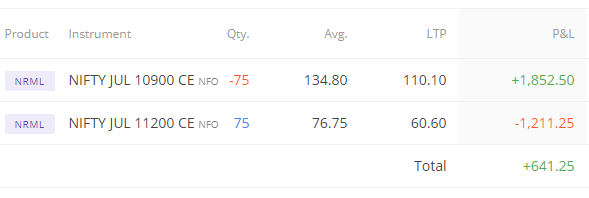

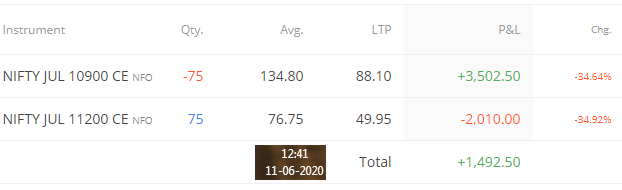

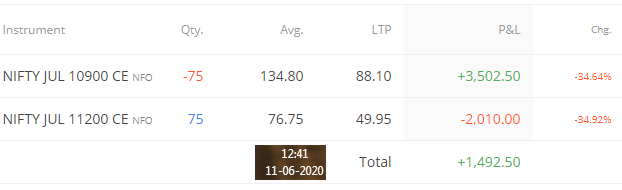

Here is the bear call credit spread trade:

Bear Call Credit Spread Trade 08-Jun-20

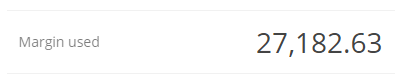

This is the trade:

BUY Nifty JUL 11200 CE One Lot

SELL Nifty JUL 10900 CE One Lot

On 08-Jun-20 Nifty was hovering around 10230, and I took this trade with a view that Nifty may not be able to break 10900 levels in the next 50 days. Well, I may be right or wrong – I do not know – but here my risk management is allowing me to trade as the risk is very low. So I went ahead with the trade.

Good news 🙂 after I took the trade Nifty started to fall:

NSE 08-Jun-20

Important Note:

I knew that if I shorted the option first the broker’s software may ask the full margin of 80k for the trade as there was no hedge existing. So what I did was, I bought the call option first then went on to sell the sold option. To my happiness and as I guessed – the trade went through with the new margin rules of hedged trades.

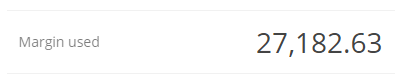

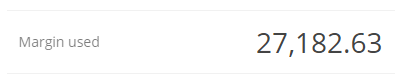

Here is the margin blocked in the bear call credit spread trade – Rs. 27,182.63:

Margin used on bear call credit spread 08-Jun-20

What used to be margin used before June 20?

Its the same, actually more now (please read above) for a sold option if you do not hedge the trade. So what you can do is just sell an option and see how much margin your broker is blocking. For Nifty option sold it will be nearly 1 lakh. Before June 20 it used to be 80,000.

Another Important Note on New Margin Rules

80% of the times, historically, India VIX is in the normal range of below 20. But what you are seeing above is the margin blocked when India VIX is in the higher zone. So I cannot give you an exact figure of what margin will be needed for a bear call credit spread when markets will go back to the normal zone after this COVID-19 pandemic (also known as the coronavirus pandemic). But I can give you an idea.

29 is approx 30% higher than 20. Of course, margin block may not reduce by 30% as it depends on other factors as well, but it may fall by 10% more when India VIX will be below 20. This comes to around 24,500.

Now let’s do some calculation. Earlier, to sell one lot nifty option, 80k used to be blocked. So in the same money, a trade can now sell 80000/25000 = 3.2 or approx three lots.

Isn’t the reduced margin blocked a piece of good news for trades as low-income traders will also be able to trade?

Well, the news is good and bad too. Why? When I take a trade I look at both sides of the coin.

Here is the calculation of max profit of the trade taken with premiums:

BUY Nifty JUL 11200 CE One Lot at 76.75

SELL Nifty JUL 10900 CE One Lot at 134.80

Max profit:

134.80 – 76.75 = 58.05 * 75 (lot size) = 4353.75

ROI (Return on Investment) = (4353.75/27,182.63)*100 = 16.01% – That’s an amazing return isn’t it?

Here is the calculation of max loss of the trade taken:

134.80-76.75 (I sold an option and bought so the final credit needs to be calculated) = 58.05

300 (distance between sold and buy strikes) – 58.05 = 241.95 points is my max loss in this trade.

241.95 * 75 = 18,146.25 is my max loss

ROI (Return on Investment) is negative if there is a loss:

(18,146.25/27,182.63)*100 = 66.75%

Now let me go back and calculate the negative ROI on one lot of the old margin blocked prior to June 20 for the same trade I have taken.

(18,146.25/80,000)*100 = 22.68%

Did you notice if there was a loss in percentage terms loss is more? In one lot frankly, it does not matter because either way, the trader will lose 18,146.25. But what if I trade 3 lots, as it’s possible in the reduced margin in 80,000. If I have the money I can right? In fact, greed will come into effect and most traders will do this. Instead of going for proper risk management, they will fall for greed and start trading more lots as they already have the money in their trading account.

Here is the max loss if a trader trades with 3 lots: 18,146.25*3 = 54,438.75

That’s a huge loss in a single trade. Now compare this with the loss when the reduced margin did not come into effect. It will be limited to 18,146.25.

So due to reduced margin, the profit potential of the option sellers have increased (for those who hedge), but on the other side, the risk to lose more money has also increased.

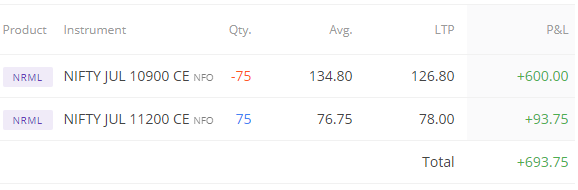

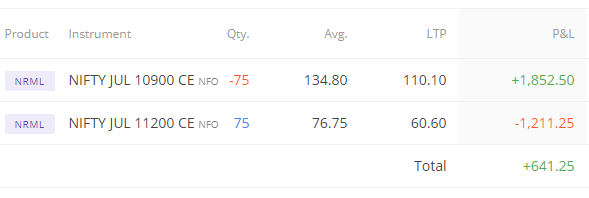

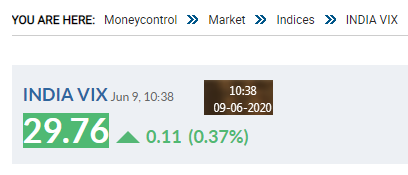

Update on 09-Jun-20 (Tuesday), Day 2 of the trade:

Remember the trade I took yesterday? If not you can see here:

Bear Call Credit Spread 09-June-20

And here was the margin blocked yesterday:

Margin used on bear call credit spread 08-Jun-20

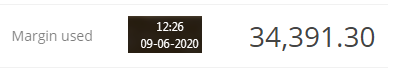

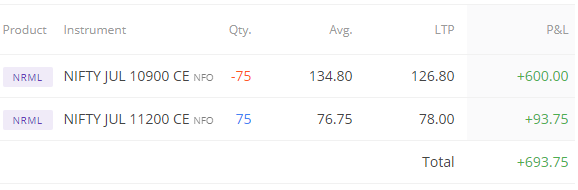

I was surprised to see an INCREASE in margin blocked the next day 09-Jun-20:

Bear Call Credit Spread Margin as on 09-Jun-20

Calculation of increase in margin:

34,391 (on 9th Jun, 20) – 27,182 (on 8th Jun, 20) = 7209

While writing this I am scratching my head. Like you, I also do not understand why they increased the margin in just one day. What is the reason behind it?

So I looked at India VIX on 9th Jun, 20 – the day margin increased:

India VIX 09-Jun-20

Source:

http://www.moneycontrol.com/indian-indices/india-vix-36.html

As you can see there is not much increase. So what I can conclude is you need to have at least 10,000 extra cash in buffer zone if you have done hedged trades and are taking the benefit of reduced margin. I really do not know what would have happened if I did not had that extra cash they blocked on the next day. Had the risk management team closed my trades? I do not have an answer to this.

There is another question in my mind. What if I exit the Call Buy option? That I am using to get the margin benefit – what will my broker do if I close the buy option and leave the sold option naked?

I feel the risk management team will automatically close the remaining naked sold option at 3.15 pm for lack of margin required. I will try to experiment that as well but when I get a good profit in the bought option, I will exit that – take a risk and leave the sold option naked by not closing it. I will then check what they do and update here.

Update on 11-June-20

I got an answer to what will my broker do if I close the buy option and leave the sold option naked?

After I sent the email to my subscribers about this, one of my subscribers DEBADYUTI did that to find out what happens when the bought option is closed and sold option is kept naked, and emailed me. Here is the reply:

Sir, I have tested.

When I exit position of the Bought option, immediately I got an SMS in my registered mobile no, “xxxxxx – your EQ margin utilization has reached 275.01% of your available balance. Add funds on kite.zerodha.com/funds immediately to avoid square off.”

(xxxxxx is my trading id)

So my guess was right. He squared off the sold option immediately to restrict the loses, however, I am sure if he did not do so, the broker would have closed the sold option automatically at 3.30 pm.

Thank you DEBADYUTI.

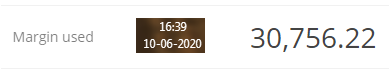

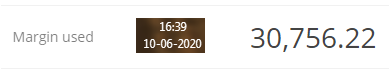

Update on 10-Jun-20 (Wednesday), Day 3 of the trade:

Margin blocked on Day 3 (T+3) reduced by approx 3000 (please note that in between the day it was swinging so I took the screenshot at End of Day EOD)

Bear Call Credit Spread Margin Blocked on 10-Jun-20

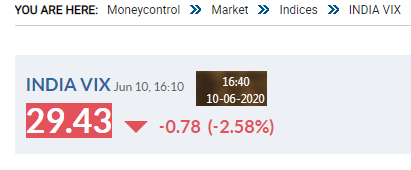

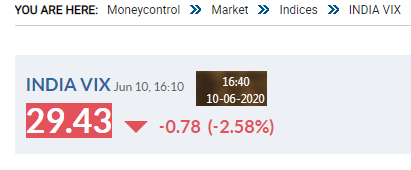

INDIA VIX on 10-Jun-20 did not change much:

INDIA VIX on 10-Jun-20

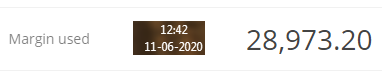

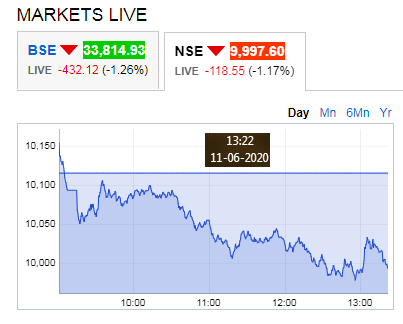

Update on 11-Jun-20 (Thursday), Day 4 of the trade:

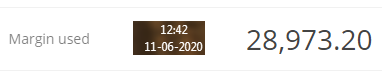

Margin blocked on Day 4 (T+4) reduced again by approx 2000:

Bear Call Credit Spread Margin Blocked on 11-Jun-20

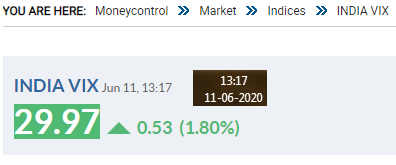

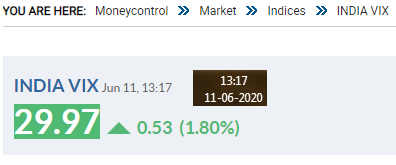

INDIA VIX on 11-Jun-20 also did not change much:

INDIA VIX on 11-Jun-20

But I noticed something which I want to share:

NSE on 08-Jun-20 (the day of the trade when the least margin was blocked – 27,182 – as per the new guidelines issued by SEBI):

NSE 8-Jun-20

NSE on 09-Jun-20 increased (the day of the trade when the margin increased by 7209 – in tune with NSE increase):

NSE 09-Jun-20

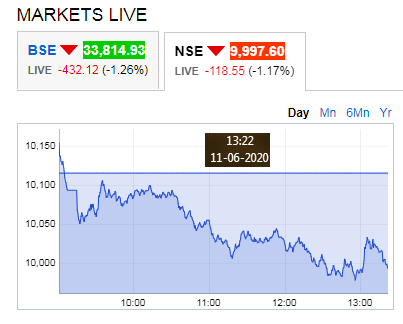

NSE on 11-Jun-20 decreased (this day the margin also decreased):

NSE 11-Jun-20

The trade as on 11-Jun-20 is in profit going with the tune as the margin decreases:

Trade as on 11-Jun-20

I hope you have guessed by now why the margin is increasing and decreasing. Since the broker’s risk is selling of the call option – they have managed the software such that if Nifty increases they will increase the margin and if Nifty decreases they will decrease the margin because their risk is also reducing.

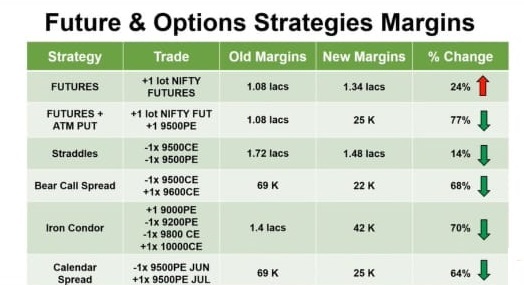

Here is a graph that explains with 10% accuracy the difference in margin blocked before and after Jun-20 is FnO hedged strategies:

Future and Options change in margin from June 20

Conclusion

So to conclude I can say that my research is over. I can say with confidence that the margin on hedged sold options and futures have reduced from June 20, but please keep at least 10,000 extra cash in your trading account for each lot traded. Because in case the trade goes against you, your broker will increase the margin and if they do not find the margin you may get a margin call or they will close the trade.

Hope this article has helped you in understanding margin requirements on hedged trades from June 20.

Testimonial by a Technical Analyst an Expert Trader - Results may vary for users

Testimonial by a Technical Analyst an Expert Trader - Results may vary for users

60% Profit Using Just Strategy 1 In A Financial Year – Results may vary for users

60% Profit Using Just Strategy 1 In A Financial Year – Results may vary for users

Testimonial by Housewife Trader - Results may vary for users

Testimonial by Housewife Trader - Results may vary for users