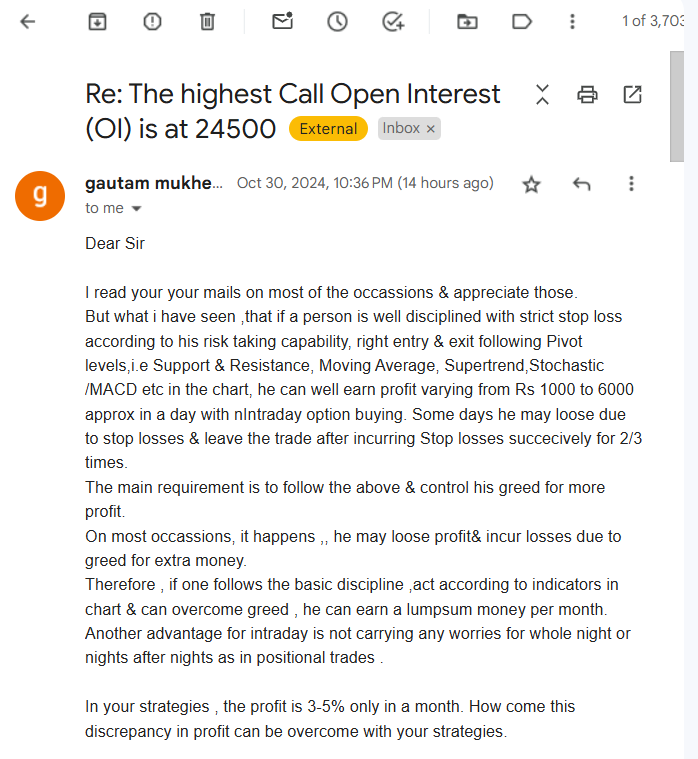

Yesterday, I received an email from a senior and highly educated executive. I noticed that even experienced people do not understand the financial markets and dream of things with no historical proof.

Everyone is greedy, including myself, but there must be some logical sense to that greed. Imagination beyond a limit can be self-destructive. Read the email to understand what I mean:

Here is my reply:

Thanks for your feedback, Mr. Gautam.

You have not mentioned making 1 to 6k daily on how much money?

Assuming it’s 20k and the mean profit is 3k then the ROI comes to 15% in a day. In 22 trading days, this equals anywhere between 250 to 350% in a month.

I have nothing more to say – the figure above is unsustainable in the long run.

No one in the history of options trading has achieved even close to this for the long term and no one will be able to do this ever.

Now coming to your question.

>>In your strategies, the profit is 3-5% only in a month. How can this discrepancy in profit be overcome with your strategies?

3-5% is NOT ONLY a month it’s quite big. It comes to 36% a year. Compare this to equity mutual funds which generate a 12% return a year.

So please think logically instead of letting your imagination go wild and start dreaming something unattainable. If you try – instead of making 6k a day you will start losing 3-4k a day.

If you still want to try take out 25k from your savings and start doing the intraday options trade as you have mentioned in your email. Do it unless you lose half then stop, or continue till you make above 100% a year. The latter will not happen.

>> My objective for writing this is to know whether any hedging or positional trade is in existence to earn an equivalent income or more compared to intraday option buying & that also with minimum investment & higher return.

No, there is no such strategy.

======================

What you can learn from this:

If you are still thinking making 5k per day is possible from 25-30k please stop dreaming. You will lose your hard-earned money. If you still feel you can just try with 25k and stop when you lose 50% of it.

Source: Google Finance

Source: Google Finance

Testimonial by a Technical Analyst an Expert Trader - Results may vary for users

Testimonial by a Technical Analyst an Expert Trader - Results may vary for users

60% Profit Using Just Strategy 1 In A Financial Year – Results may vary for users

60% Profit Using Just Strategy 1 In A Financial Year – Results may vary for users

Testimonial by Housewife Trader - Results may vary for users

Testimonial by Housewife Trader - Results may vary for users