First: Budget 2024 in short for investors and traders:

Here are the key takeaways:

1) Higher Capital Gains Taxes

Long-term gains tax: 10% to 12.5%

Short-term gains tax: 15% to 20%

2) No Indexation Benefit – No indexation on investments, disappointing for investors.

What is indexation? Indexation adjusts the purchase price of an asset for inflation, reducing taxable profits and tax liabilities.

For example, you made a 30% profit in 3 years but the inflation for the last three years was at 5% every year. Then you pay taxes on 30 – (5+5+5) = 15% profit only, not 30%. But since this indexation benefit has been taken away, you will have to pay taxes of 30% even if you made this profit in 10 years.

3) Increased Tax Exemption

Capital gains tax exemption limit: ₹1 lakh to ₹1.25 lakh/year

4) Higher Securities Transaction Tax (STT)

Futures STT: Increased from 0.0125% to 0.02%

Options STT: Increased from 0.0625% to 0.1%

5) NPS Vatsalya for Minors

A new pension scheme allows contributions for minors, which become theirs upon adulthood.

How to Save Money From These Taxes?

Tax-Loss Harvesting. I did some research but could not find a correct solution. Then I used my expertise and found out an idea – here it is:

If you do not know tax-loss harvesting is a legal trick to save taxes on the short-term & long-term gains.

Let me explain with an example.

Step 1) Let us assume you bought two company shares – XYZ & ABC company shares both for 1 lakh. After six months XYZ company is giving at 30% profit and ABC company is giving a 40% loss.

Step 2) Now sell both. On paper, you have taken a 30,000 – 40,000 = -10,000/- short-term loss.

Step 3) The next day buy the ABC company shares (the one in which you took a 40k loss) for 60,000. Note that after selling ABC company shares you received 60,000 after taking a loss of 40,000. Use the same amount i.e. 60,000 to buy ABC company shares.

Step 4) DO NOT sell the ABC company shares for one year.

Thats it. Instead of paying Short-Term Capital Gains (STCG) Tax on 30,000, you can carry forward the 10,000 short-term loss for the next 8 years and adjust against any short-term gains in future to save taxes.

So you not only saved taxes but carried forward a 10k loss to be adjusted in future against any short-term gains.

You can carry forward your losses – both short and long-term for 8 assessment years immediately following the assessment year in which the loss was first computed.

Make sure to file these losses on your IT return so that when you book profits you can adjust these profits against the losses and either pay no tax or pay less tax on STCG & LTCG.

You can do the same to save money on Long-Term Capital Gains tax. Here is an example:

Let us assume you have shares of two companies – ABC and XYZ company of 1 lakh each. After 1 year ABC is running at a loss of 20k and XYZ at a profit of 15k. You can sell both. Currently, you have an overall 5k loss. Now do not buy the shares of the company you booked profit in. Next day buy shares of ABC company in which you took the loss. Hold it till the next financial year. That’s it – instead of paying taxes on the profit you made you can file a carry forward loss of 5k and adjust against any gains made in the long term in ABC company or any other company shares for the next 8 years.

Is Tax Loss Harvesting possible in derivative trading?

No. Unfortunately, you cannot do this in derivative trading.

Actually, you can but closing a Future / Option and buying / selling it again will cost you huge Securities Transaction Tax (STT). See above. The cost of STT will be so high that it will offset the profits and increase the losses.

So tax loss harvesting is not recommended in derivatives trading unless you are an exceptional trader.

Securities Transaction Tax (STT) has almost been doubled and it just cannot be saved. It is charged on every trade you take. Unlike GST it doesn’t even have a credit input. It is a tax that you have to pay even if you have taken a Short Term or Long Term Capital Loss.

The only way out is to be a profitable trader. Losers in derivative trading will now lose more due to an increase in STT.

You can do my conservative options and futures course and learn hedged and stress-less strategies that will make small but consistent profits.

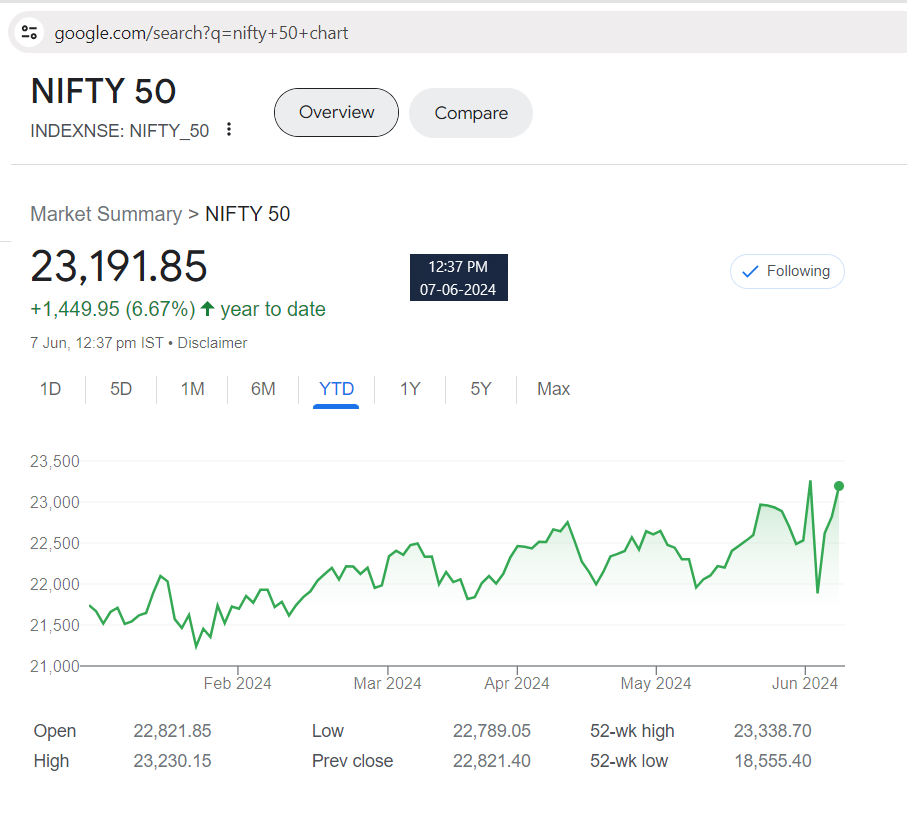

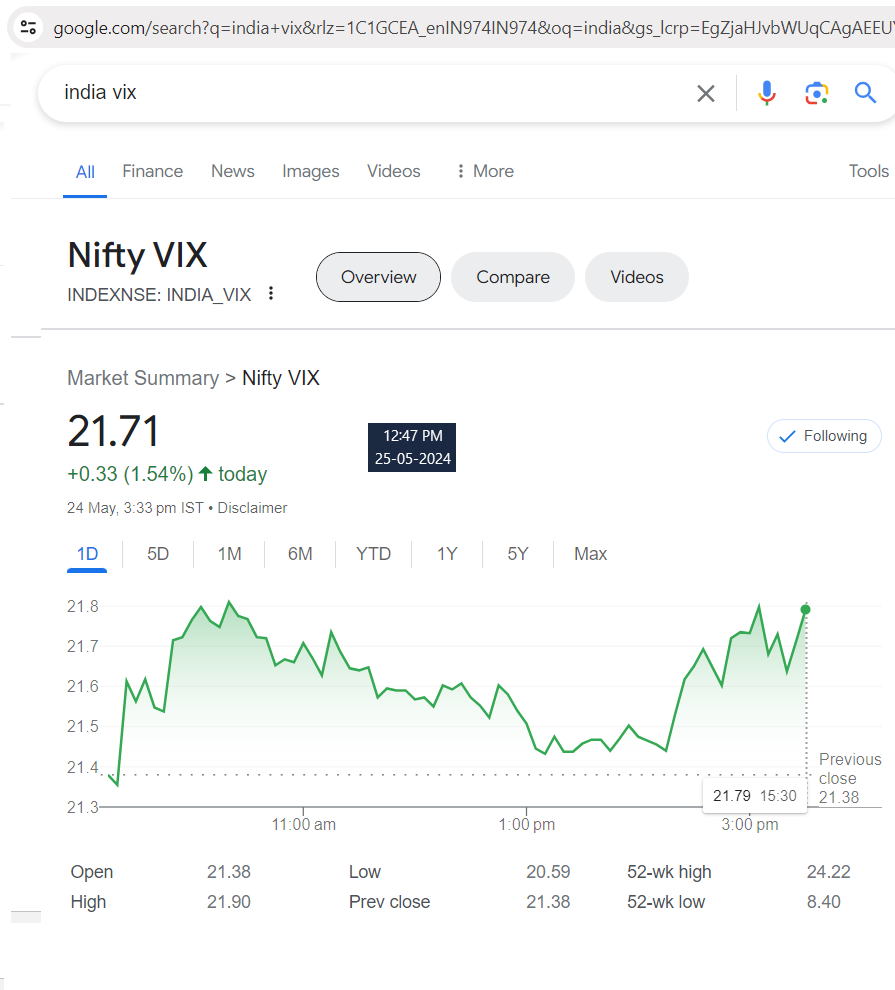

The higher the INDIA VIX the higher the risk.

The higher the INDIA VIX the higher the risk.

It is expected to go up till the 4th of June 2024 – the day General Election 2024 Results will be out. Wait for a few more days – 5 trading days – then start trading. If you are an exceptional trader then trade with 50% of your normal capacity. The next 15-20 days of less profit will not make much difference to your life. However, increased volatility will be hard to manage if you trade with a higher number of lots. The psychological impact can do the damage, not your trading skills.

It is expected to go up till the 4th of June 2024 – the day General Election 2024 Results will be out. Wait for a few more days – 5 trading days – then start trading. If you are an exceptional trader then trade with 50% of your normal capacity. The next 15-20 days of less profit will not make much difference to your life. However, increased volatility will be hard to manage if you trade with a higher number of lots. The psychological impact can do the damage, not your trading skills. Testimonial by a Technical Analyst an Expert Trader - Results may vary for users

Testimonial by a Technical Analyst an Expert Trader - Results may vary for users

60% Profit Using Just Strategy 1 In A Financial Year – Results may vary for users

60% Profit Using Just Strategy 1 In A Financial Year – Results may vary for users

Testimonial by Housewife Trader - Results may vary for users

Testimonial by Housewife Trader - Results may vary for users