Disclaimer: I DO NOT give tips or advisory services. This website is for educational purposes only. Full Disclaimer!!

Date of post: 06-Apr-20

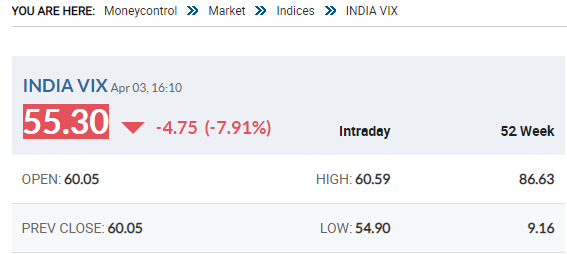

Since last few days, India VIX is dropping. See this image:

From a high of 86.63 to 55.30 in less than 30 days.

What does it mean?

It means that traders are assuming that the worst has happened and some kind of normalcy may resume in a few days so fear factor is decreasing.

Does this guarantee that normal trading will resume soon and that Nifty will now start to go up?

Well, nothing is guaranteed in stock markets else everyone would put 100% of what they earn in stock markets. But this gives some indication that in the near future (30 to 60 days) normalcy will resume.

So what can you do?

Right now you still have to trade with caution and if possible intraday only with a single lot. Positional trading is a big no.

Just trade with strict stop loss and target. Do not change the target or stop loss whatever happens.

Hope this helps.

Other articles on India VIX by me:

How India VIX Is Calculated and What to Expect After Seeing High or Low India VIX

Impact on Nifty Bank Nifty India VIX due to General Elections 2019

Click to Share this website with your friends on WhatsApp

COPYRIGHT INFRINGEMENT: Any act of copying, reproducing or distributing any content in the site or newsletters, whether wholly or in part, for any purpose without my permission is strictly prohibited and shall be deemed to be copyright infringement.

INCOME DISCLAIMER: Any references in this site of income made by the traders are given to me by them either through Email or WhatsApp as a Thank You message. However, every trade depends on the trader and his level of risk-taking capability, knowledge and experience. Moreover, stock market investments and trading are subject to market risks. Therefore there is no guarantee that everyone will achieve the same or similar results. My aim is to make you a better & disciplined trader with the stock trading and investing education and strategies you get from this website.

DISCLAIMER: I am NOT an Investment Adviser (IA). I do not give tips or advisory services by SMS, Email, WhatsApp or any other forms of social media. I strictly adhere to the laws of my country. I only offer education for free on finance, risk management & investments in stock markets through the articles on this website. You must consult an authorized Investment Adviser (IA) or do thorough research before investing in any stock or derivative using any strategy given on this website. I am not responsible for any investment decision you take after reading an article on this website. Click here to read the disclaimer in full.

My student gets the Winner's Certificate of Zerodha 60-day Challenge - Click here and Open Stock Buy and Sell Free Account with Them Today!!!

Testimonial by a Technical Analyst an Expert Trader - Results may vary for users

Testimonial by a Technical Analyst an Expert Trader - Results may vary for users

60% Profit Using Just Strategy 1 In A Financial Year – Results may vary for users

60% Profit Using Just Strategy 1 In A Financial Year – Results may vary for users

Testimonial by Housewife Trader - Results may vary for users

Testimonial by Housewife Trader - Results may vary for users