Disclaimer: I DO NOT give tips or advisory services. This website is for educational purposes only. Full Disclaimer!!

There is no need to bother about single-day gains or losses in the stock markets. A single-day stock market loss or gain has no impact on long-term returns. Read below to understand better.

This is what happened on Tuesday, 4th of June 2024 – the day the General Election Results 2024 were being declared and the ruling party (BJP) was not able to garner seats as per their expectations. The markets had a great run before the results day because almost every exit poll in the country gave a clear majority to the current government.

But when things did not go as expected mayhem followed due to panic selling. This is what happened on that day:

Why it happened?

Because 70-80% of the investors (not real data but my assumption based on my experience over 20 years of investing and trading) are short-term investors (people who invest in a stock for a few days to make quick money), these are the people who panic and start selling. Then what happens is called the hyperbole effect. Media comes in and starts shouting on top of their voices – markets are tanking and investors are losing lakhs and crores. The novice investor sees this and in a panic sells his stocks.

Tip: Do not see live business news on TV or YouTube. I have stopped seeing it for years. Instead, read business news in newspapers online or offline. They have limited space and therefore cannot exaggerate news. Plus reading doesn’t make you panic, seeing live news does. Moreover, newspapers report the news the next day – by that time you have already avoided a situation which could have made you panic and take the wrong trade.

Most Important Advice: Do not sell a stock because everyone is selling based on news even if you by chance see it live on TV. Sell a stock only when you want to book profit or the company’s fundamentals have changed and it looks like it will take a very long time for the company to correct its fundamentals.

On that day (4th of June, 2024) this happened in terms of money:

The All India Market Capitalization index, tracked on the Bombay Stock Index, lost over 31.06 trillion rupees, or about $371 billion on Tuesday, June 4, 2024 alone. The losses meant the Sensex index erased all its gains this year in a single day, going from a 5.85% year-to-date gain on Monday to a 0.22% loss position on the next day.

Source: https://www.cnbc.com/2024/06/05/india-stocks-erase-over-371-billion-after-bjp-disappoints-in-elections.html

But who lost? Only those who sold their holdings in loss, not those who sold in profit. So please do not look at these numbers. These numbers are calculated based on overall index market capitalization (03-Jun-2024 close minus 04-Jun-2024 close multiplied by total market capitalization). This is not the total loss got by adding all the losses in each demat account. This is simply not possible but that data is very interesting and important. The real loss of investors will be much smaller than what is shown in the media.

Similarly, the markets gained by many trillion rupees the next day which does not mean that everyone who holds stocks in Indian markets made a lot of money.

Unfortunately, gains are never highlighted by the media – only the losses are blown out of proportion which gets them TRP (Television Rating Point) which in turn gets them more advertising revenues i.e. money. When this happens the business channels on TV and vloggers on YouTube make money – the investors who listen to them lose heavily.

Therefore I repeat the advice I gave above – Do not see live business news on TV or YouTube. It’s noise and it is better ignored.

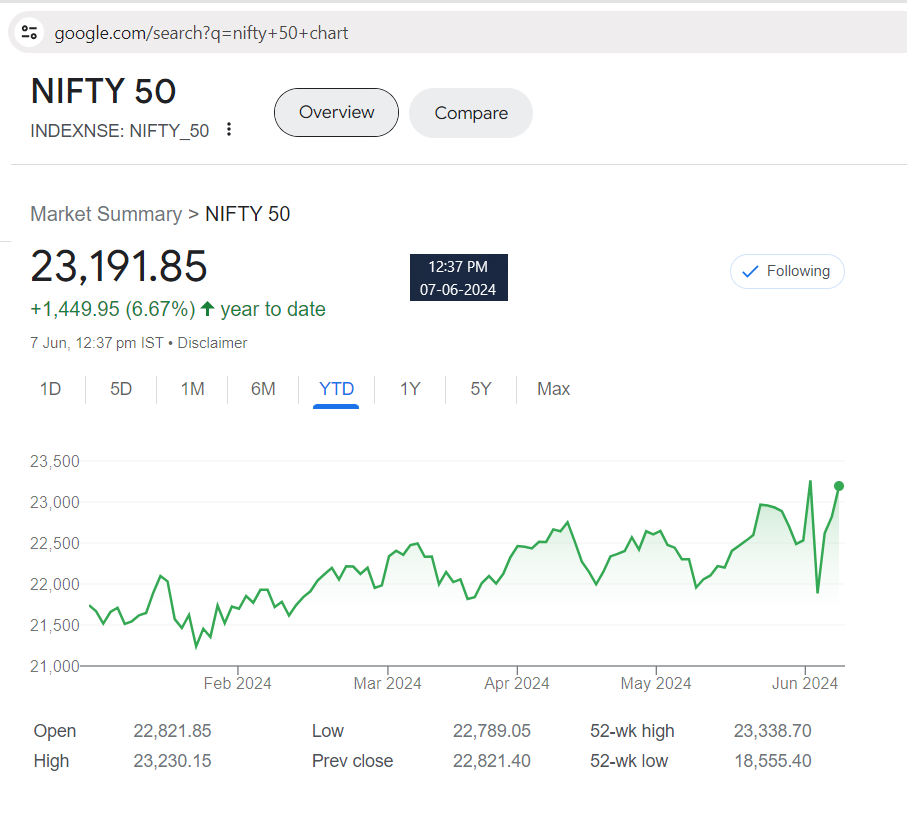

Here is proof of why a single day’s gains or losses in the stock markets must be ignored. As of writing this post Nifty 50 has given a return of 6.67% from 01-Jan-2024 to 07-Jun-2024:

Nifty 50 returns from 01-Jan-24 to 07-Jun-24

Therefore you should ignore stock markets’ single-day losses or gains. It does not impact the long-term investors. The best way to avoid making panic trades or investing decisions is to stop seeing live stock market news on TV news channels and YouTube.

Click to Share this website with your friends on WhatsApp

COPYRIGHT INFRINGEMENT: Any act of copying, reproducing or distributing any content in the site or newsletters, whether wholly or in part, for any purpose without my permission is strictly prohibited and shall be deemed to be copyright infringement.

INCOME DISCLAIMER: Any references in this site of income made by the traders are given to me by them either through Email or WhatsApp as a Thank You message. However, every trade depends on the trader and his level of risk-taking capability, knowledge and experience. Moreover, stock market investments and trading are subject to market risks. Therefore there is no guarantee that everyone will achieve the same or similar results. My aim is to make you a better & disciplined trader with the stock trading and investing education and strategies you get from this website.

DISCLAIMER: I am NOT an Investment Adviser (IA). I do not give tips or advisory services by SMS, Email, WhatsApp or any other forms of social media. I strictly adhere to the laws of my country. I only offer education for free on finance, risk management & investments in stock markets through the articles on this website. You must consult an authorized Investment Adviser (IA) or do thorough research before investing in any stock or derivative using any strategy given on this website. I am not responsible for any investment decision you take after reading an article on this website. Click here to read the disclaimer in full.

My student gets the Winner's Certificate of Zerodha 60-day Challenge - Click here and Open Stock Buy and Sell Free Account with Them Today!!!

Testimonial by a Technical Analyst an Expert Trader - Results may vary for users

Testimonial by a Technical Analyst an Expert Trader - Results may vary for users

60% Profit Using Just Strategy 1 In A Financial Year – Results may vary for users

60% Profit Using Just Strategy 1 In A Financial Year – Results may vary for users

Testimonial by Housewife Trader - Results may vary for users

Testimonial by Housewife Trader - Results may vary for users